Table of Content

Table of Contents

A Non-Profit Organization

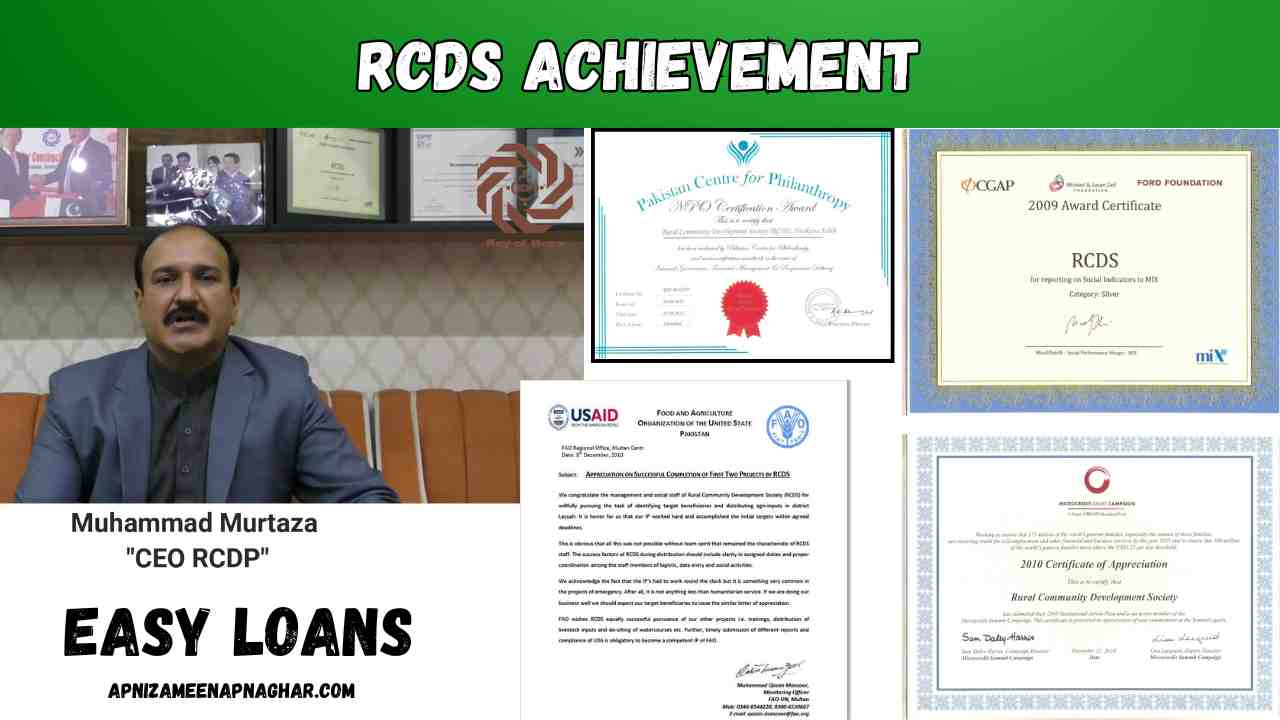

From RCDS to RCDP

RURAL COMMUNITY DEVELOPMENT SOCIETY (RCDP loan programs)

Rural Community Development Programme (RCDP) ki shuruaat hui Rural Community Development Society (RCDS) ke qiyaam se, jo ke 1995 mein Societies Registration Act XXI of 1860 ke tehat banai gayi aik ghair munafa bakhsh tanzeem hai. RCDS ko kuch jawan university graduates, social scientists, philanthropists, aur mukhtalif fields ke professionals ne mil kar banaya, jinhon ne NGOs ke sath Pakistan aur bahar ka kaafi tajurba hasil kiya tha. Mr. Muhammad Murtaza ki qiyadat mein in logon ne aik aisi idara banaya jo grassroots development aur social welfare ke liye kaam kare. Unhon ne apna safar District Nankana Sahib se shuru kiya aur RCDS ke naam se organization ko formally register karwaya.

RCDS ne apne social sector programmes ka aghaz kiya, jismein 1998 mein microcredit initiative bhi shamil tha, jiska maqsad communities mein economic activities ko barhawa dena tha, khaaskar aurton ke liye. April 2001 mein, RCDS ne Pakistan Poverty Alleviation Fund (PPAF) ke sath partnership ki, taake Punjab ke mukhtalif ilaqon mein apni integrated development services ka dائرہ farakh kiya ja sake. Is dauraan organization ne institutional development aur sustainability par zyada focus kiya. PPAF ke sath mil kar RCDS ne operational manuals, methodologies, aur aik comprehensive framework tayar kiya taake financial aur non-financial services faraham ki ja sakein, khaaskar dehati ilaqon ke ghareeb logon ko. PPAF ke partner organization ke tor par RCDS ne apni capability aur expertise ka saboot diya.

RCDS Partnerships with National and International Donors

RCDS ne apni history mein kai national aur international donors ke sath partnerships banai, jinmein FAO, UNDP, USAID, ASF, The Asia Foundation, Plan International, Embassy of Japan, Unilever International, Engro Foundation, aur Pakistan ke mukhtalif donors shamil hain. In collaborations ne RCDS ki aik multifaceted rural development organization ke tor par reputation mazid mazboot ki.

Maintaining Commitment

Urban ilaqon mein underserved logon tak apni services pohanchane ke liye, RCDS ne urban areas ke gareeb households tak apni reach barhai. Ismein social mobilization, non-formal schools ka قیام, aur microfinance services ka extension shamil hai, taake slum areas mein log informal income activities mein hissa le saken.

RCDS ne mukhtalif integrated programs implement kiye jo development challenges ko address karte hain: social mobilization, health services (antenatal aur postnatal care, safe deliveries), livelihood enhancement, employment aur enterprise development, community infrastructure, farmer enterprise, agribusiness, emergency response (floods), youth development, vocational skills, non-formal education, widow empowerment, aur entrepreneurial development. In tamam efforts ke zariye RCDS ne marginalized communities ke liye positive impact create kiya hai.

RURAL COMMUNITY DEVELOPMENT PROGRAMME (RCDP loan programs)

2015 mein Muhammad Murtaza ne RCDP ka qiyaam kiya, jo Punjab aur Pakistan ke financially marginalized communities ke liye umeed ki kiran bana. RCDP ne chhoti muddat mein apne mission ke zariye microfinance ka istimaal karte hue socioeconomic empowerment aur financial inclusion faraham ki.

EK TABDEELI KA VISION

Muhammad Murtaza ka mission tha ke microfinance ko poverty alleviation aur community development ke liye tool banaya jaye. Unka focus tha ke log, khaaskar aurtein, khud-mukhtaar hon aur apni communities mein economic role ada karein.

EXPANSION AUR IMPACT

Aaj RCDP 30 districts mein kaam kar raha hai, 1.5 million borrowers tak services pohncha chuka hai, jismein 97% women hain. RCDP ne women empowerment ke zariye communities mein economic change laayein.

FINANCIAL MILESTONES

2015 se ab tak RCDP ne Rs. 72 billion ke qarz disburse kiye hain. Iska high repayment rate unke borrower engagement aur credit systems ki kamyabi ka saboot hai.

MICROFINANCE KE ZARIYE ZINDAGIYON MEIN TABDEELI

RCDP ke loans ne chhoti farming se le kar home-based businesses tak logon ko empower kiya. Yeh services un ilaqon mein le jaye gaye jahan financial institutions nahi pohanchte.

EK KAMYAB MODEL

RCDP ne borrower-centric model banaya jo financial literacy, skill building aur community engagement par mabni hai. Borrowers ko clients nahi, development ke partner samjha jata hai.

MUSTAQBIL KI JANIB

RCDP ka mission hai ke aur zyada logon tak financial services pohanchai jayein. Muhammad Murtaza ki leadership mein RCDP ne Pakistan ka microfinance landscape badal diya hai.

PROGRAMMES AUR INSTITUTIONAL EVOLUTION

RCDS ne donors ke sath strong partnerships develop ki, aur microfinance ko separate legal entity banane ka faisla kiya. 2015 mein RCDS ne RCDP ko launch kiya taake financial inclusion ke core programme par focus kiya ja sake.

LEGAL STATUS

RCDP ko SECP ke tehat Section 42 Companies Ordinance 1984 ke zariye register kiya gaya. RCDP ne 2 June 2016 ko NBFC license ke liye apply kiya.

OUR SERVICES

TRANSACTIONAL BANKING

RCDP ne loan disbursement aur repayment process ko asaan banane ke liye over-the-counter cash aur intermediary banking partners ka use shuru kiya hai — National Financial Inclusion Strategy ke mutabiq.

DIGITAL FINANCIAL SERVICES

State Bank ke framework ke tahat RCDP ne DFS (mobile wallets, e-wallets, P2P, G2P, P2G) introduce kiye, jisse unbanked logon ko financial access mila.

SAVING MOBILIZATION

BOP log ziada save karte hain — RCDP MFBs, MFIs aur banks ke sath mil kar unke resources ko manage karta hai taake long-term financial stability ho.

CREDIT & LIFE INSURANCE

RCDP ne borrowers ke liye life insurance introduce kiya hai — jismein loan amount cover hota hai aur client ki death par family ko PKR 7,000 ka funeral benefit milta hai.

CAPACITY BUILDING

Loan lene se pehle training aur skill development mandatory hai. RCDP forward/backward linkages ke zariye entrepreneurship ko bhi promote karta hai.

MICROINSURANCE

Low-income families ke liye loan repayment aur funeral expenses cover karne ke liye RCDP ka microinsurance plan hai. Yeh un families ko unexpected events ke doran support karta hai.

Rural Community Development Programmes (RCDP) – Operational Statistics (31st May 2026 tak)

| Indicator | Value |

| Disbursement (May 2026 ka) | Rs. 1,967,960,100 |

| Recovered Amount (May 2026 ka) | Rs. 1,858,932,988 |

| Cumulative Disbursement (Total ab tak) | Rs. 92,465,381,012 |

| Outstanding Loan Portfolio | Rs. 12,057,507,951 |

| Recovery Rate | 99.82% |

| Active Clients | 260,841 |

| Female Participation | 98% (aurat clients) |

| Households Served (Shuru se ab tak) | 1,608,561 gharanay |

| Women Enterprises Developed | 60% se zyada |

GOLD BACKED LOAN – RCDP loan programs

RCDP ne haal hi mein aik Gold Backed Loan product launch kiya hai, jo khaas tor par micro aur chhote business walon, agriculture aur livestock sector mein kaam karne walon, aur low-income salaried individuals ke liye design kiya gaya hai. Is loan mein sone (gold) ko collateral ke taur par istemal kiya jata hai, aur humara focus sirf default risk control par nahi, balki customer ki sahulat par hai.

Ye customer-centric approach clients ki zarurat ko behtareen tor par samajhti hai aur unhein asaan aur accessible financing provide karti hai.

Eligibility & Zaroori Documents

- Age: Minimum 18 saal, Maximum 58 saal

- Valid CNIC hona zaroori hai

- Collateral: Sona (Gold bar, jewelry, ya ornaments)

- Account Number: Disbursement ke liye zaroori (Agar koi masla ho to XPIN issue ho sakta hai)

- Income Proof: Wajah honi chahiye loan wapas karne ki

- Married / Unmarried: Dono eligible hain

- Business: Apna business kam az kam 1 saal se hona chahiye

- Witness: Preferably qareebi family member ya branch se koi ho

- Guarantor/Witness/Spouse: Jo kisi doosre RCDP product mein active ho, wo bhi eligible hain (same age criteria apply hoga)

Loan Ki Muddat (Tenure)

- 12 se 24 mahine tak

Loan Ki Raqam

- Rs. 100,000 se Rs. 1,000,000 tak

Credit & Enterprise Development Loan – RCDP

RCDP apni community ko chhoti scale ke business ke liye Credit Enterprise Development Loans provide karta hai. Ye loans chhoti dukaanon, handicrafts, silai machines, phalon ki dukan, sabzi dukan, kharghosh (donkey) carts, aur aise hi dusray related businesses ke liye available hain.

In loans ka maqsad ghurbat ko kam karna hai aur clients ko dheere dheere zyada loan facilities ki taraf le jana hai taake wo apna business barha saken.

Eligibility & Zaroori Documents

- Age: 18 se 58 saal tak

- Loan Sirf Business Purpose ke liye diya jayega

- Valid CNIC (Computerized National Identity Card)

- Utility Bill ki Copy: Ghar ya business ka (bill 3 mahine se purana na ho)

- Social Collateral & Stamp Paper: Rs. 100 ke stamp paper par social collateral

- Tasveerain: 2 recent passport size photographs

- Identity Proof: Social collateral wale ki CNIC ki photocopy

Loan Amount

- Rs. 40,000 se Rs. 80,000 tak

Ye loan un logon ke liye behtareen hai jo apne chhote business ko aage barhana chahte hain aur sustainable livelihood create karna chahte hain.

Business Enhancement Loan – RCDP loan programs

Business Enhancement Loan un entrepreneurs ke liye hai jo pehle CED (Credit Enterprise Development) loan kam az kam do dafa le chuke hain aur apna business expand karna chahte hain. Is loan ke zariye wo apne business mein mazeed investment karke apni sales aur munafa barha sakte hain.

Eligibility & Zaroori Documents

- Age: 18 se 58 saal ke darmiyan

- Loan Sirf Business Purpose ke liye

- Valid National Identity Card (CNIC)

- Utility Bill ki Copy: Ghar ya business ka, jo aakhri 3 mahine mein issue hua ho

- Social Collateral & Stamp Paper: Rs. 100 ke stamp paper par social collateral

- Tasveerain: 2 recent passport size photographs

- Identity Proof: Social collateral wale ki CNIC ki photocopy

Loan Amount

- Rs. 85,000 se Rs. 150,000 tak

Enterprise Development Facility (EDF) – RCDP

RCDP ki taraf se Enterprise Development Facility (EDF) un clients ke liye hai jo apne business ko barhana chahte hain. EDF flexible financial support provide karta hai taake business growth, expansion, aur innovation aasani se ho sake.

Is ke ilawa, RCDP apne clients ko exclusive training aur capacity building programs bhi deta hai, jo business ko mazboot banane mein madadgar sabit hote hain. Financial aur developmental support ka ye combination businesses ko apni poori salahiyat tak pohanchne mein madad karta hai.

Eligibility & Zaroori Documents

- Age: 18 se 58 saal tak

- Loan Sirf Business Purpose ke liye

- Valid CNIC (National Identity Card)

- Utility Bill ki Copy: Ghar ya business ka, aakhri 3 mahine mein issue hua hua ho

- Social Collateral: Rs. 100 ke stamp paper aur cheque dena zaroori hai

- Tasveerain: 2 recent passport size photographs

- Identity Proof: Social collateral wale ki CNIC ki photocopy

- Additional: Client ko cheque aur stamp paper provide karna hota hai

Loan Amount

Rs. 150,000 se Rs. 250,000 tak

Strengthening Micro Enterprise Loan – RCDP

Strengthening Micro Enterprise (SME) Loan Program entrepreneurs ko apna business expand karne ke liye zaroori capital provide karta hai. Ye loan un micro-entrepreneurs ke liye specially design kiya gaya hai jo aam tor par unregistered chhote business chalate hain jaise manufacturing, handicrafts, trade, furniture workshops, etc.

Is program se shoe manufacturing, garments, iron & steel products, agricultural products, aur dairy/food products ke chhote business bhi faida utha sakte hain, khas tor par wo jo kam az kam 3 employees ko rozgaar dete hain aur business growth ke zariye naye rozgaar ke mauqe paida kar sakte hain.

Eligibility & Zaroori Documents

Umr: 18 se 58 saal ke darmiyan

- Loan Sirf Business (Entrepreneurial) Purpose ke liye

- Business Experience: Kam az kam 3 saal ka tajurba zaroori hai

- Business Evaluation: Loan approve hone se pehle client ki repayment capacity ka evaluation hoga

- Employees: Kam az kam 3 aur zyada se zyada 5 employees hone chahiye

- Child Labor: Sakhti se mana hai

- Valid CNIC zaroori hai

- Utility Bill: Ghar ya business ka jo 3 mahine se purana na ho

- Social Collateral References: 2 chahiye (ek family se aur doosra family ke bahar)

- Internal Guarantor: Cheque aur stamp paper dono dena hoga

- External Guarantor: Cheque ya stamp paper me se koi ek dena hoga

- Photographs: 2 recent passport size tasveerain deni hongi

- Social Collateral Guarantor ki CNIC ki photocopy deni hogi

- Personal Account Checks: Applicant aur ek social guarantor dono ke account checks dena honge

Loan Amount

Rs. 150,000 se Rs. 500,000 tak

Livestock Financing – RCDP

Dairy farming gaon ki maeeshat mein bohat ahm kirdar ada karta hai aur kisano ke liye aik bara zaraye-e-rozgar hai. Behtareen milk dene walay animals kharidna har aqalmand dairy farmer ki tarjeeh hoti hai, magar maali wasail ki kami unhein is kaam se rok deti hai.

RCDP ne Livestock Financing ka intizam kiya hai taake kisan behtareen animals khareed kar milk aur meat ki barhti hui demand poori kar saken aur apne business se achha munafa kama saken.

Eligibility & Zaroori Documents

- Umr: 18 se 58 saal ke darmiyan

- Loan Sirf Business Growth ke liye

- Animals: Kam az kam 2 aur zyada se zyada 3 milk dene wale animals ke malik hone chahiye

- Valid CNIC (National Identity Card) zaroori hai

- Utility Bill: Ghar ya business ka, jo 3 mahine se purana na ho

- Social Collateral aur Stamp Paper zaroori hai

- Tasveerain: 2 recent passport size photographs deni hongi

- Social Collateral Guarantor ki CNIC ki photocopy bhi deni hogi

Loan Amount

- Rs. 75,000 se Rs. 200,000 tak

Solar Home Solutions Loan (SHS) – RCDP

SHS loan product un gharo aur business walon ke liye hai jo bijli ki sahulat se mehroom hain ya load shedding jese masail ka samna kar rahe hain. RCDP is loan ke zariye aapko bijli ki masail ka hal dena chahta hai taake aap apni zindagi aur business ko behtari ki taraf le ja saken.

Eligibility & Zaroori Documents

- Umr: 18 se 58 saal tak

- Applicant ka permanent resident hona zaroori hai

- Applicant ka CNIC, social security, surety check, aur stamp paper required hain

- 2 recent photographs deni hongi

- Affidavit aur Covenant bhi dena hoga

- Sirf 5% down payment order confirmation ke liye deni hoti hai

- Solar installation 14 din ke andar complete karni hoti hai down payment ke baad

Loan Amount

Rs. 500,000 tak, jo 3.5 kW aur 5.2 kW solar systems ke liye finance karta hai

Prime Minister Interest Free Loan (IFL) – RCDP

RCDP Punjab mein aik ahem development organization hai jo economic prosperity ko promote karta hai. Isi objective ke tahat, RCDP ne 32 Interest Free Loan (IFL) Centers banaye hain un deprived aur neglected communities ke liye jinka poverty score sabse zyada hai aur jo interest ya fees ada karne ki salahiyat nahi rakhte.

Yeh IFL centers khas tor par districts Layyah, Pakpattan, Jhang, aur Okara mein qaim kiye gaye hain.

Eligibility & Zaroori Documents

- Application office mein submit karni hoti hai

- Loan tabhi sanction hota hai jab credit committee us ilaqay mein social appraisal kare

- Age: 18 se 58 saal ke darmiyan

- Loan sirf business ke liye diya jata hai

- Valid CNIC (Computerized National Identity Card) zaroori hai

Loan Amount

- Rs. 75,000 tak

Apni Chhat Apna Ghar Program – RCDP

“Apni Chhat Apna Ghar” Program Chief Minister Punjab ka ek khaas initiative hai jo RCDP ke zariye Punjab bhar mein implement ho raha hai. Is program ka maqsad un afraad ko finance provide karna hai jo zameen ya plot ke malik hain magar apna ghar banane ke liye maali resources nahi rakhte.

Is program ko Punjab Housing & Town Planning Agency execute karti hai, jabke Housing, Urban Development and Public Health Engineering Department (HUD&PHED) iska administrative nigrani karti hai.

Eligibility

- Land Ownership:

- Rural areas mein zameen max 10 Marla tak

- Urban areas mein zameen max 5 Marla tak

- Age: 18 se 45 saal ke darmiyan

Zaroori Documents

- Property registration ke individual documents

- Applicant ke 2 passport size photographs

- Applicant ka valid CNIC ki copy

- Police Character Certificate (jo 2 mahine se zyada purana na ho)

- Do guarantors ke identity card ki copies

- Dono sureties ke 1-1 photograph

- Dono sureties ke valid CNIC ki copies (expiration date pe nazar)

- Applicant ke naam Rs. 100 ke stamp paper

Loan Amount

- Rs. 1,500,000 tak

Prime Minister Youth Business Loan – RCDP

Prime Minister’s Youth Business and Agriculture Loan Scheme (PMYB&ALS) Pakistan ki hukumat ka ek initiative hai jo naujawanon mein entrepreneurship aur self-employment ko promote karta hai. Is scheme ke zariye young individuals apna business start ya expand kar sakte hain ya agricultural activities mein engage ho sakte hain.

RCDP is loan product ke zariye community mein self-employment ke mauqe paida karta hai aur chhote aur darmiyani businesses (SMEs) aur agriculture ko support karke economic growth ko barhawa deta hai.

Eligibility & Zaroori Documents

- Umr: 18 se 45 saal tak

- Applicant ke paas viable business plan ya agricultural business plan hona chahiye

- 2 passport size photographs

- Valid CNIC ki copy

- Do guarantors ke identity cards ki copies

- Dono sureties ke 1-1 photograph

- Dono sureties ke valid CNIC copies (expiration date check karein)

- Guarantor ka Rs. 100 ka stamp paper

Loan Amount

- Rs. 500,000 tak

Murabaha Financing – RCDP

RCDP ka maqsad hai ke woh na sirf maali balki ghair-maali khidmaat bhi mehfooz aur kamzor tabqaat tak pohanchaye, khaas tor par khawateen ko empower karne par tawajjo deta hai. Is initiative ke zariye, RCDP Islamic financing provide karta hai taake business entrepreneurs apne business ke liye zaroori assets purchase kar saken aur apne business ko barha saken.

Features

- Ye ek Murabaha trade hai jisme RCDP apne esteemed customers ko assets bechta hai jisme cost aur profit dono transparent hote hain.

Eligibility & Conditions

- Umr: 18 se 58 saal tak

- Applicant ka permanent resident hona zaroori hai

- Applicant ke paas valid CNIC hona chahiye

- Applicant ke 2 recent photographs required hain

- Permanent residence ka saboot dena hoga

- Sirf 5% down payment order confirmation ke liye dena hota hai

Loan Apply Karna Hai?

Agar aap RCDP ke loan ke liye apply karna chahte hain, to yahan click karein:

Apply for Loan

Yeh link aapko direct application form par le jaayega. Apni zaroori maloomat ke saath form complete karen aur apna loan process start karen!

RCDP Contact Information

Email: rcdp@rcdppk.org

Phone: +92 42 3717 0280-81

+92 42 3719 0777

Address: House # 4-D, Al-Rehman Garden, Phase-II, Near Faizpur Interchange, Lahore, Pakistan

FAQs – RCDP loan programs

RCDP se loan ke liye apply karne ka tareeqa kya hai?

Aap official website https://rcdppk.org/apply-for-loan/ par ja kar online application form bhar sakte hain. Form bharne ke baad aapko loan process ki further instructions milengi.

Loan ke liye eligibility criteria kya hai?

Eligibility har loan product ke liye mukhtalif hoti hai, magar aam tor par umar 18 se 58 saal ke darmiyan honi chahiye, valid CNIC hona zaroori hai, aur business ya agriculture ka plan hona chahiye.

Loan ki maximum aur minimum raqam kya hai?

Loan amount product ke mutabiq Rs. 40,000 se lekar Rs. 1,500,000 tak ho sakti hai.

Kya RCDP sirf rural areas mein loans deta hai?

Nahi, RCDP rural aur urban dono ilaqon ke afraad ko loan facility provide karta hai, magar kuch schemes khas rural areas ke liye hain.

Kya loan lena asaan hai?

Haan, RCDP apne clients ki sahulat ke liye aasaan eligibility aur document requirements rakhta hai, taake zyada se zyada log is se faida uthaa saken.

Loan repayment ki terms kya hain?

Loan repayment ki duration aur terms har loan product ke hisaab se vary karti hain, aam tor par 12 se 24 mahine tak hoti hain. Details ke liye loan product ki specific information check karen.

Kya RCDP Islamic financing bhi deta hai?

Jee haan, RCDP Murabaha Islamic financing bhi offer karta hai jo business assets ke liye hota hai.

Kya main apne ghar ke liye bhi loan le sakta hoon?

Haan, “Apni Chhat Apna Ghar” program ke zariye aap apne ghar banane ke liye loan hasil kar sakte hain agar aap eligible hain.

Loan ke liye documents kya chahiye?

Aam tor par CNIC, utility bill, passport size photographs, social collateral aur guarantor documents required hote hain. Har scheme ke liye document list alag hoti hai.

Loan lene ke baad kisi madad ya support ke liye kahan contact karen?

Aap RCDP ke office se ya email rcdp@rcdppk.org par rabta kar sakte hain, ya phone numbers +92 42 3717 0280-81, +92 42 3719 0777 par call kar sakte hain.

Loan Minimum Current Percentage Till June 2026 ?

22% profit till june 2025 for bussiness. next change b hosakta hay or khatam b

Insurance free hoti hay sath me ?

Nahi 2400/- fees hay insurance ki for 1 year – depend k konsa packgae or kitny time ka lia hay – Tabdell bhi ho sakti hay Helpline sy latest confirm kar skate hain

Note:

Ye maloomat kisi organization ki taraf se publicly available information par mabni hai aur sirf general maloomat ke liye share ki gayi hai. Is mein waqt ke sath tabdeeli ho sakti hai, is liye updated aur sahih maloomat ke liye hamesha official sources se raabta karna zaroori hai. Official Website https://rcdppk.org/